All Categories

Featured

Table of Contents

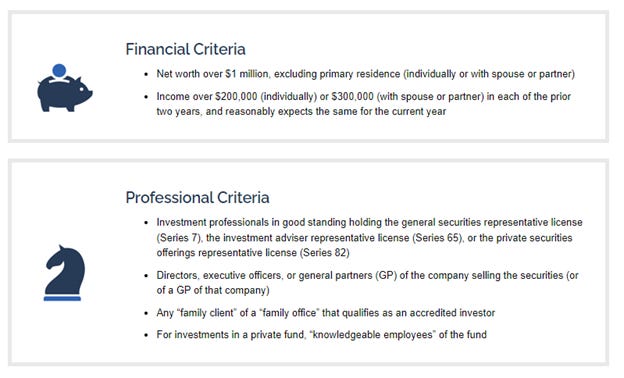

Investments involve danger; Equitybee Stocks, participant FINRA Accredited capitalists are one of the most professional financiers in the business. To certify, you'll require to satisfy several needs in income, total assets, asset dimension, governance condition, or expert experience. As an approved financier, you have access to a lot more complex and innovative kinds of safety and securities.

Enjoy access to these different financial investment opportunities as a certified investor. Read on. Accredited investors usually have an earnings of over $200,000 independently or $300,000 jointly with a spouse in each of the last two years. AssetsPrivate CreditMinimum InvestmentAs reduced as $500Target Holding PeriodAs short as 1 month Percent is a private credit history financial investment platform.

Venture Capital For Accredited Investors

To earn, you just need to join, purchase a note offering, and wait on its maturity. It's an excellent resource of passive revenue as you don't need to check it carefully and it has a short holding duration. Excellent annual returns range between 15% and 24% for this possession class.

Possible for high returnsShort holding period Funding in jeopardy if the customer defaults AssetsContemporary ArtMinimum Financial investment$15,000 Target Holding Period3-10 Years Masterworks is a platform that securitizes blue-chip artworks for financial investments. It gets an artwork through auction, then it registers that possession as an LLC. Beginning at $15,000, you can invest in this low-risk property course.

Get when it's supplied, and then you get pro-rated gains once Masterworks offers the art work. Although the target period is 3-10 years, when the art work gets to the wanted worth, it can be sold previously. On its internet site, the most effective gratitude of an artwork was a massive 788.9%, and it was just held for 29 days.

Yieldstreet has the widest offering across different financial investment systems, so the amount you can gain and its holding period vary. There are products that you can hold for as brief as 3 months and as lengthy as 5 years.

Esteemed Accredited Investor Passive Income Programs

It can either be paid to you monthly, quarterly, or once an occasion occurs. Among the downsides here is the reduced yearly return rate contrasted to specialized systems. It offers the very same items, some of its rivals exceed it. Its monitoring cost generally ranges from 1% - 4% annually.

In addition, it obtains lease income from the farmers during the holding duration. As an investor, you can make in 2 means: Obtain rewards or cash return every December from the rent paid by tenant farmers.

Streamlined High Yield Investment Opportunities For Accredited Investors

Farmland as an asset has traditionally low volatility, which makes this a fantastic option for risk-averse investors. That being stated, all investments still carry a particular level of danger.

Additionally, there's a 5% charge upon the sale of the whole residential or commercial property. Stable asset Yearly cash money yield AssetsCommercial Real EstateMinimum InvestmentMarketplace/C-REIT: $25,000; Thematic Finances: $100,000+Target Holding PeriodVaries; 3 - ten years CrowdStreet is a business actual estate financial investment platform. It buys different deals such as multifamily, self-storage, and industrial residential or commercial properties.

Managed fund by CrowdStreet Advisors, which automatically diversifies your investment throughout numerous properties. exclusive investment platforms for accredited investors. When you buy a CrowdStreet offering, you can get both a money yield and pro-rated gains at the end of the holding duration. The minimum financial investment can vary, but it generally starts at $25,000 for industry offerings and C-REIT

Real estate can be usually low risk, yet returns are not assured. While some properties might return 88% in 0.6 years, some possessions lose their value 100%. In the background of CrowdStreet, even more than 10 buildings have unfavorable 100% returns. CrowdStreet does not charge any type of charges, but you may require to pay enrollers costs for the monitoring of the properties.

Value Accredited Investor Property Investment Deals

While you won't obtain ownership below, you can potentially get a share of the earnings once the startup successfully does a leave occasion, like an IPO or M&A. Numerous excellent companies remain exclusive and, for that reason, frequently inaccessible to capitalists. At Equitybee, you can money the stock alternatives of staff members at Stripe, Reddit, and Starlink.

The minimum financial investment is $10,000. This platform can possibly offer you huge returns, you can likewise shed your whole cash if the start-up stops working.

When it's time to exercise the option throughout an IPO or M&A, they can benefit from the possible rise of the share cost by having a contract that permits them to get it at a price cut (Accredited Investor Opportunities). Gain Access To Hundreds of Startups at Past Valuations Diversify Your Profile with High Development Start-ups Purchase a Previously Unattainable Possession Course Based on accessibility

Alpine Note is a temporary note that offers you fairly high returns in a short period. It can either be 3, 6, or 9 months long and has a fixed APY of 6% to 7.4%. It additionally uses the Ascent Earnings Fund, which buys CRE-related senior financial obligation loans. Historically, this revenue fund has actually outmatched the Yieldstreet Choice Earnings Fund (formerly known as Yieldstreet Prism Fund) and PIMCO Revenue Fund.

All-In-One Top Investment Platforms For Accredited Investors for Accredited Investment Portfolios

Plus, they no much longer publish the historical performance of each fund. Short-term note with high returns Absence of transparency Complex costs framework You can qualify as an accredited investor utilizing 2 standards: economic and professional capabilities.

There's no "test" that approves an accreditor financier license. One of one of the most vital things for a certified investor is to shield their resources and expand it at the very same time, so we picked assets that can match such different danger hungers. Modern spending systems, specifically those that supply alternate possessions, can be fairly uncertain.

To make sure that recognized financiers will certainly be able to create an extensive and diverse profile, we chose systems that might fulfill each liquidity need from short-term to lasting holdings. There are numerous investment possibilities recognized capitalists can explore. However some are riskier than others, and it would certainly depend upon your threat hunger whether you would certainly go for it or not.

Approved investors can expand their financial investment profiles by accessing a broader variety of asset courses and investment methods. This diversity can help reduce threat and improve their general profile efficiency (by staying clear of a high drawdown percentage) by lowering the dependancy on any kind of solitary investment or market sector. Certified financiers usually have the opportunity to connect and team up with other like-minded financiers, sector specialists, and entrepreneurs.

Table of Contents

Latest Posts

Investing In Tax Liens In Texas

Otc Tax Liens

How To Buy Land That Owes Back Taxes

More

Latest Posts

Investing In Tax Liens In Texas

Otc Tax Liens

How To Buy Land That Owes Back Taxes