All Categories

Featured

Table of Contents

- – High-Quality Accredited Investor Opportunities

- – High-End Accredited Investor Opportunities

- – Cost-Effective Accredited Investor Investment...

- – Exclusive Accredited Investor Crowdfunding Op...

- – Cost-Effective Accredited Investor Investmen...

- – Sought-After Top Investment Platforms For Ac...

- – Reliable Accredited Investor Investment Netw...

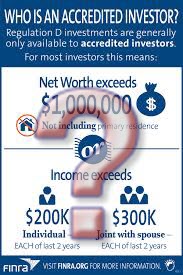

The regulations for recognized financiers differ amongst territories. In the U.S, the interpretation of a certified financier is placed forth by the SEC in Guideline 501 of Law D. To be an accredited capitalist, a person needs to have an annual earnings exceeding $200,000 ($300,000 for joint income) for the last two years with the assumption of earning the same or a higher income in the existing year.

This quantity can not consist of a key residence., executive police officers, or directors of a business that is releasing non listed securities.

High-Quality Accredited Investor Opportunities

If an entity is composed of equity proprietors that are certified investors, the entity itself is an accredited financier. However, a company can not be developed with the sole objective of purchasing specific safety and securities - accredited investor funding opportunities. A person can certify as a certified financier by demonstrating sufficient education or job experience in the financial industry

Individuals who want to be recognized investors do not put on the SEC for the classification. Instead, it is the obligation of the company using a private positioning to see to it that every one of those approached are certified capitalists. Individuals or events that intend to be recognized capitalists can approach the issuer of the non listed safeties.

For example, mean there is an individual whose revenue was $150,000 for the last 3 years. They reported a primary residence worth of $1 million (with a home loan of $200,000), an auto worth $100,000 (with an impressive lending of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

This person's web worth is exactly $1 million. Given that they satisfy the net worth demand, they certify to be a certified investor.

High-End Accredited Investor Opportunities

There are a few much less typical credentials, such as managing a depend on with greater than $5 million in possessions. Under federal safety and securities regulations, just those who are certified capitalists may join particular safety and securities offerings. These may consist of shares in private positionings, structured products, and private equity or bush funds, among others.

The regulators wish to be certain that participants in these very risky and intricate financial investments can look after themselves and judge the dangers in the absence of government security. The certified investor rules are made to secure potential financiers with limited economic understanding from adventures and losses they may be ill furnished to stand up to.

Recognized investors fulfill qualifications and professional standards to accessibility unique investment opportunities. Designated by the United State Stocks and Exchange Payment (SEC), they gain entry to high-return choices such as hedge funds, venture resources, and exclusive equity. These investments bypass full SEC registration however bring higher dangers. Certified capitalists should fulfill earnings and total assets needs, unlike non-accredited individuals, and can invest without restrictions.

Cost-Effective Accredited Investor Investment Returns

Some vital changes made in 2020 by the SEC include:. This change recognizes that these entity types are commonly utilized for making investments.

These amendments broaden the certified financier pool by about 64 million Americans. This larger access gives much more possibilities for investors, but also enhances potential threats as less monetarily advanced, capitalists can participate.

One major benefit is the chance to buy placements and hedge funds. These financial investment options are exclusive to accredited investors and organizations that qualify as a recognized, per SEC regulations. Personal positionings allow companies to protect funds without navigating the IPO procedure and regulatory documentation required for offerings. This gives certified financiers the possibility to buy emerging firms at a stage before they take into consideration going public.

Exclusive Accredited Investor Crowdfunding Opportunities for Accredited Investors

They are considered as investments and are available just, to certified clients. In addition to recognized companies, qualified capitalists can select to purchase startups and up-and-coming endeavors. This provides them income tax return and the opportunity to go into at an earlier stage and possibly enjoy rewards if the company succeeds.

For capitalists open to the threats entailed, backing startups can lead to gains (accredited investor property investment deals). Many of today's tech business such as Facebook, Uber and Airbnb came from as early-stage startups supported by approved angel investors. Innovative financiers have the chance to explore investment alternatives that may generate a lot more revenues than what public markets supply

Cost-Effective Accredited Investor Investment Networks

Returns are not ensured, diversification and portfolio improvement options are broadened for capitalists. By diversifying their portfolios via these broadened investment avenues recognized financiers can enhance their strategies and potentially accomplish remarkable long-lasting returns with appropriate danger administration. Seasoned investors frequently encounter financial investment choices that might not be quickly readily available to the basic investor.

Investment choices and safeties offered to accredited investors generally include higher threats. Exclusive equity, endeavor capital and bush funds usually concentrate on investing in possessions that bring risk but can be sold off conveniently for the possibility of greater returns on those risky investments. Researching before spending is critical these in circumstances.

Lock up durations stop financiers from withdrawing funds for even more months and years on end. Capitalists might have a hard time to properly value private assets.

Sought-After Top Investment Platforms For Accredited Investors

This adjustment might extend recognized investor condition to a variety of individuals. Upgrading the earnings and property criteria for inflation to ensure they mirror modifications as time advances. The existing thresholds have remained static given that 1982. Allowing partners in dedicated partnerships to integrate their resources for common eligibility as accredited financiers.

Enabling people with specific expert qualifications, such as Series 7 or CFA, to certify as recognized investors. This would acknowledge financial class. Producing additional requirements such as proof of financial proficiency or effectively completing a certified capitalist exam. This could ensure capitalists comprehend the dangers. Limiting or eliminating the main residence from the total assets calculation to lower potentially filled with air analyses of riches.

On the other hand, it can additionally result in experienced capitalists assuming too much risks that might not be appropriate for them. So, safeguards might be needed. Existing accredited capitalists might encounter boosted competition for the best investment opportunities if the pool expands. Companies increasing funds might gain from an increased recognized investor base to attract from.

Reliable Accredited Investor Investment Networks

Those that are currently thought about accredited capitalists must remain upgraded on any type of changes to the criteria and guidelines. Organizations seeking certified financiers must stay attentive about these updates to ensure they are drawing in the best target market of financiers.

Table of Contents

- – High-Quality Accredited Investor Opportunities

- – High-End Accredited Investor Opportunities

- – Cost-Effective Accredited Investor Investment...

- – Exclusive Accredited Investor Crowdfunding Op...

- – Cost-Effective Accredited Investor Investmen...

- – Sought-After Top Investment Platforms For Ac...

- – Reliable Accredited Investor Investment Netw...

Latest Posts

Investing In Tax Liens In Texas

Otc Tax Liens

How To Buy Land That Owes Back Taxes

More

Latest Posts

Investing In Tax Liens In Texas

Otc Tax Liens

How To Buy Land That Owes Back Taxes