All Categories

Featured

Table of Contents

In really general terms, unregulated safeties are believed to have greater risks and higher rewards than managed investment cars. It is very important to bear in mind that SEC regulations for certified investors are created to shield capitalists. Unregulated securities can supply phenomenal returns, but they likewise have the prospective to develop losses. Without oversight from economic regulatory authorities, the SEC merely can not review the threat and incentive of these investments, so they can not provide details to inform the typical capitalist.

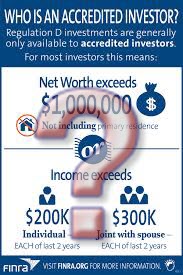

The concept is that capitalists that make enough earnings or have adequate riches are able to absorb the danger better than financiers with lower income or much less riches. Accredited Investor Opportunities. As an approved financier, you are anticipated to finish your own due persistance prior to adding any kind of asset to your investment portfolio. As long as you satisfy among the complying with four requirements, you certify as a recognized financier: You have actually made $200,000 or more in gross income as a specific, annually, for the previous two years

You and your spouse have had a combined gross earnings of $300,000 or more, each year, for the previous two years. And you anticipate this degree of revenue to continue.

Cutting-Edge Accredited Investor Investment Returns

Or all equity proprietors in the business qualify as accredited capitalists. Being an approved capitalist opens doors to investment possibilities that you can not access otherwise. As soon as you're approved, you have the option to invest in uncontrolled protections, which includes some superior financial investment chances in the realty market. There is a large range of property investing strategies available to capitalists who don't presently fulfill the SEC's requirements for accreditation.

Ending up being a recognized financier is just a matter of confirming that you fulfill the SEC's needs. To verify your earnings, you can provide documents like: Earnings tax obligation returns for the previous 2 years, Pay stubs for the past two years, or W2s for the previous 2 years. To validate your total assets, you can supply your account declarations for all your assets and liabilities, consisting of: Cost savings and inspecting accounts, Financial investment accounts, Superior finances, And realty holdings.

High-Quality Accredited Investor Growth Opportunities for Accredited Investors

You can have your attorney or certified public accountant draft a confirmation letter, confirming that they have actually examined your financials which you meet the demands for an accredited investor. It might be much more cost-efficient to make use of a solution specifically designed to validate recognized capitalist conditions, such as EarlyIQ or .

If you sign up with the genuine estate investment firm, Gatsby Financial investment, your accredited capitalist application will be processed via VerifyInvestor.com at no cost to you. The terms angel capitalists, advanced investors, and accredited financiers are commonly used mutually, yet there are refined differences. Angel financiers give venture capital for start-ups and tiny companies for possession equity in the business.

Typically, anybody who is recognized is assumed to be an advanced capitalist. The income/net worth requirements continue to be the same for international financiers.

Here are the ideal financial investment chances for recognized capitalists in real estate.

Elite Accredited Investor Financial Growth Opportunities

Some crowdfunded realty financial investments don't require certification, but the jobs with the greatest prospective rewards are normally booked for certified capitalists. The difference between tasks that approve non-accredited capitalists and those that only accept certified financiers typically boils down to the minimum investment quantity. The SEC currently limits non-accredited investors, that earn less than $107,000 annually) to $2,200 (or 5% of your annual income or total assets, whichever is less, if that amount is greater than $2,200) of financial investment capital each year.

It is really comparable to genuine estate crowdfunding; the procedure is basically the very same, and it comes with all the exact same benefits as crowdfunding. Genuine estate submission uses a secure LLC or Statutory Trust fund ownership version, with all financiers offering as participants of the entity that possesses the underlying actual estate, and a distribute who facilitates the project.

a firm that buys income-generating realty and shares the rental revenue from the properties with investors in the type of rewards. REITs can be publicly traded, in which case they are controlled and readily available to non-accredited investors. Or they can be private, in which instance you would certainly require to be certified to invest.

All-In-One Accredited Investor Investment Funds for Accredited Investment Portfolios

Administration costs for a private REIT can be 1-2% of your complete equity each year Purchase charges for new acquisitions can come to 1-2% of the purchase price. And you may have performance-based charges of 20-30% of the personal fund's profits.

While REITs focus on tenant-occupied buildings with steady rental income, personal equity real estate firms concentrate on genuine estate development. These companies commonly develop a plot of raw land into an income-generating home like a home complicated or retail shopping mall. As with personal REITs, investors secretive equity ventures generally need to be certified.

The SEC's meaning of recognized financiers is developed to recognize people and entities deemed financially sophisticated and efficient in evaluating and taking part in particular kinds of personal financial investments that may not be offered to the public. Relevance of Accredited Capitalist Standing: Conclusion: In verdict, being an accredited financier carries substantial value on the planet of money and investments.

Cutting-Edge Exclusive Deals For Accredited Investors

By satisfying the standards for certified investor condition, individuals show their economic elegance and access to a globe of financial investment possibilities that have the prospective to generate substantial returns and add to lasting monetary success (accredited investor investment networks). Whether it's buying start-ups, real estate ventures, personal equity funds, or various other different possessions, approved capitalists have the opportunity of exploring a varied array of investment choices and constructing wide range by themselves terms

Certified capitalists include high-net-worth people, financial institutions, insurer, brokers, and trust funds. Certified capitalists are defined by the SEC as certified to purchase facility or innovative sorts of safety and securities that are not very closely managed. Particular criteria have to be fulfilled, such as having an ordinary yearly income over $200,000 ($300,000 with a spouse or cohabitant) or working in the monetary market.

Unregistered safety and securities are inherently riskier due to the fact that they lack the typical disclosure demands that feature SEC enrollment. Investopedia/ Katie Kerpel Accredited investors have fortunate accessibility to pre-IPO firms, venture capital business, hedge funds, angel investments, and numerous deals entailing complex and higher-risk investments and tools. A company that is seeking to raise a round of financing may determine to straight come close to certified investors.

Table of Contents

Latest Posts

Investing In Tax Liens In Texas

Otc Tax Liens

How To Buy Land That Owes Back Taxes

More

Latest Posts

Investing In Tax Liens In Texas

Otc Tax Liens

How To Buy Land That Owes Back Taxes